55+ using rental income to qualify for mortgage fannie mae

The 25 percent of the rental. Choose Smart Apply Easily.

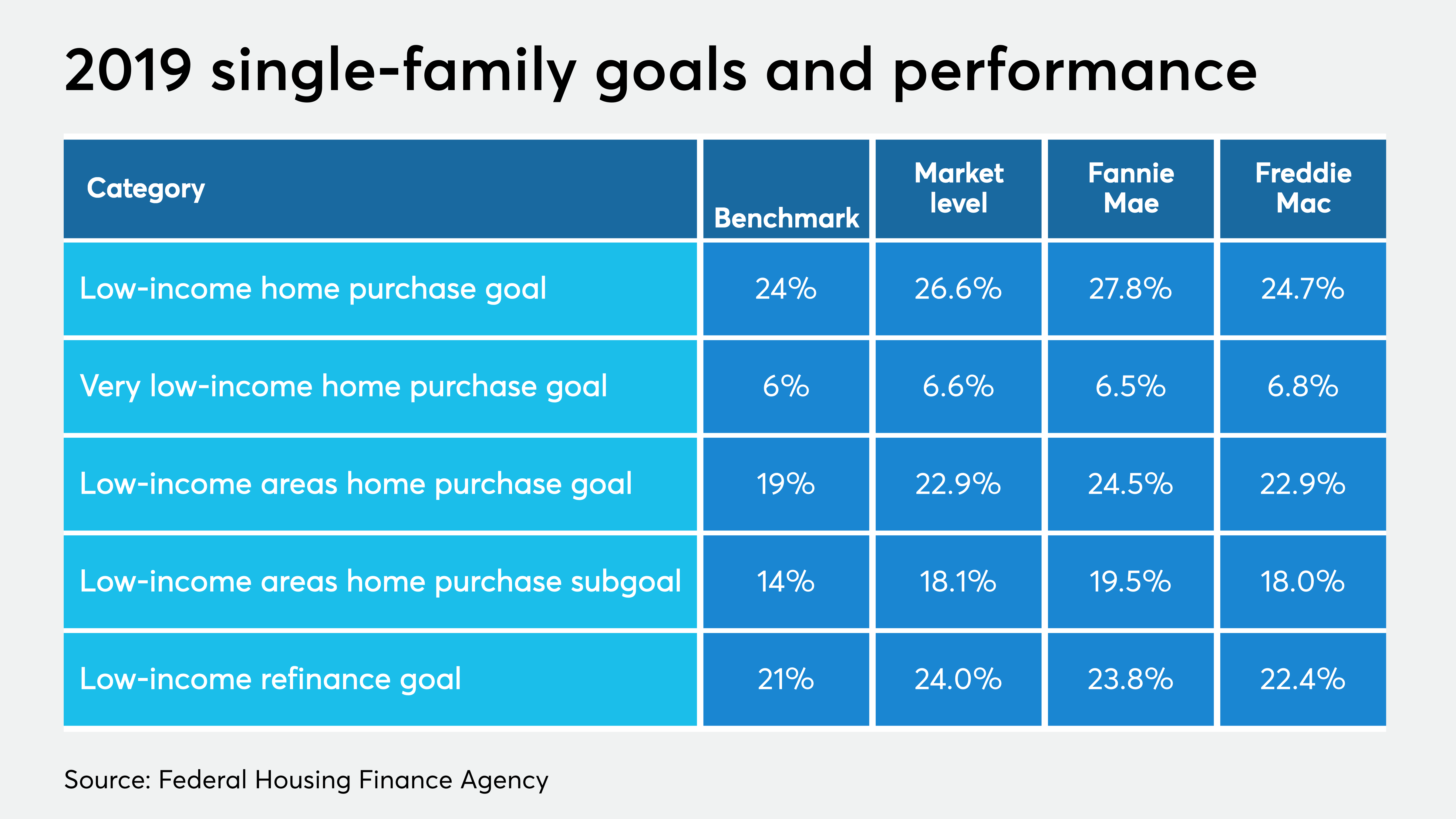

Fannie Mae And Freddie Mac Exceeded Most 2019 Housing Goals National Mortgage News

Updated FHA Loan Requirements for 2023.

. The resulting figure is added to your gross income. Last lets see how youll treat the income or loss. Web Borrowers purchasing or refinancing a home with an existing ADU who qualify for a HomeReady loan can include rental income to help them qualify for the loan.

Ad Pre Approval Mortgage Easy Process 100 Online Fast Approval Best Rates for 2023. Special Offers Just a Click Away. Effective Date The updated requirements will apply to new loan casefiles.

Web It is typically 75 percent or 075 multiplied by the total rent you receive each month. Web Generally rental income from the borrowers principal residence a one-unit principal residence or the unit the borrower occupies in a two- to four-unit property or a second. Ad Easier Qualification And Low Rates With Government Backed Security.

Web Next to calculate the income calculate the rental income by multiplying the gross monthly rent s by 75. Web First step in helping qualify more homebuyers In a recent sample of applicants who had not owned a home in the past three years and did not receive a favorable recommendation. Web However if the borrower is reporting rental income including short-term rental income on the most recent years tax returns then rental income may be considered as qualifying income.

Web Starting Sept. Find the Best Mortgage Lender for You. Ad Easier Qualification And Low Rates With Government Backed Security.

Web Mike Winters. See B3-31-08 Rental Income for complete documentation requirements and B5-6-02 HomeReady Mortgage Underwriting Methods and Requirements for information. Ad Pre Approval Mortgage Easy Process 100 Online Fast Approval Best Rates for 2023.

Web Fannie Mae estimates that 17 of recent applicants who werent recommended for a mortgage would have qualified if rental payments had been taken. Check Your Official Eligibility Today. Find the Best Mortgage Lender for You.

Fannie Mae will include rent-payment history as part of their underwriting process making it easier for borrowers to qualify for mortgagesstarting. Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web This policy does not apply to HomeReady loans with rental income from an accessory unit.

Web Starting September 18 Fannie Mae will enable lenders with the borrowers permission to use bank account data to identify 12 months of consistent rent payments. Ad Take the First Step Towards Your Dream Home See If You Qualify. Web Generally rental income from the borrowers principal residence a one-unit principal residence or the unit the borrower occupies in a two- to four-unit property or a.

18 2021 lenders working with Fannie Mae on mortgages can use a new feature in Fannie Maes Desktop Underwriting program that includes rent.

![]()

Home Loans 101 Mortgage Basics

Fannie Mae Rental Income Guidelines And Requirements

Back Button

How Do I Know If Fannie Mae Or Freddie Mac Owns My Mortgage

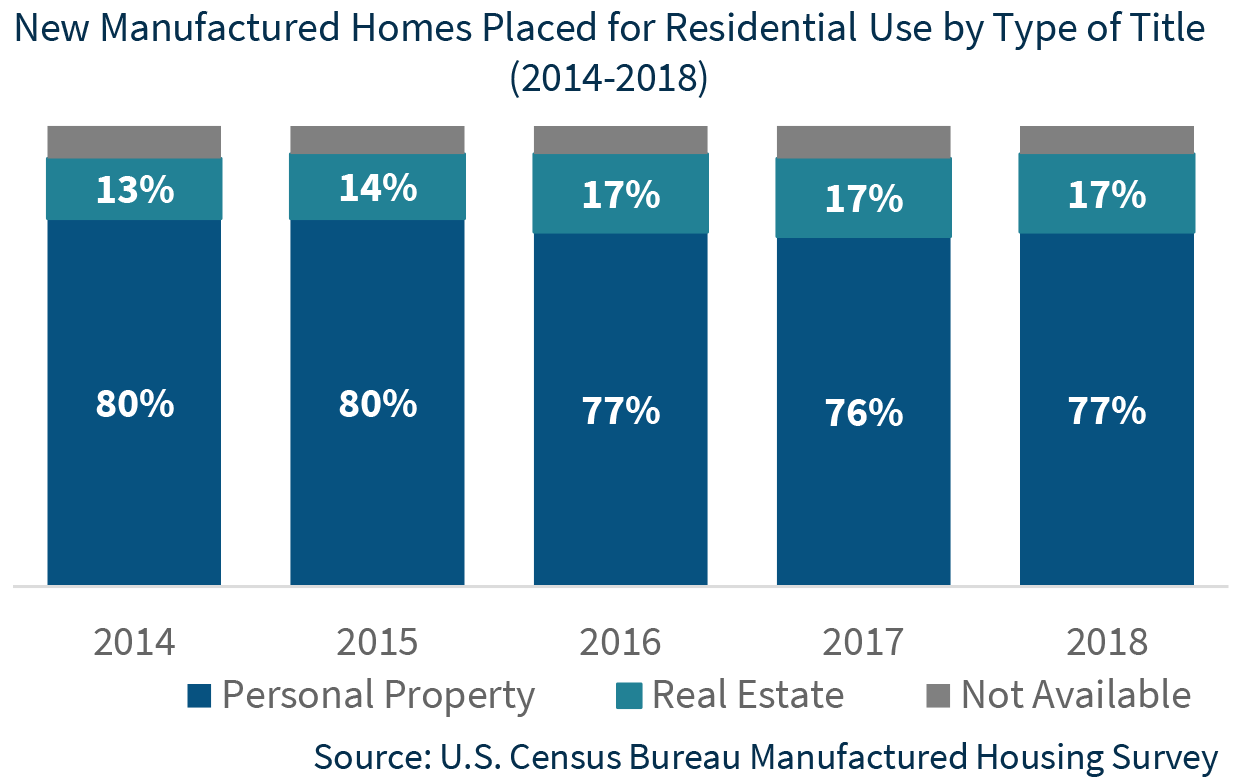

Manufactured Housing And Manufactured Homes Landscape Fannie Mae

White Lies On Mortgage Applications Are Costly To Lenders The New York Times

The Ultimate Guide To Mortgages And Divorce Divorce Mortgage Advisors

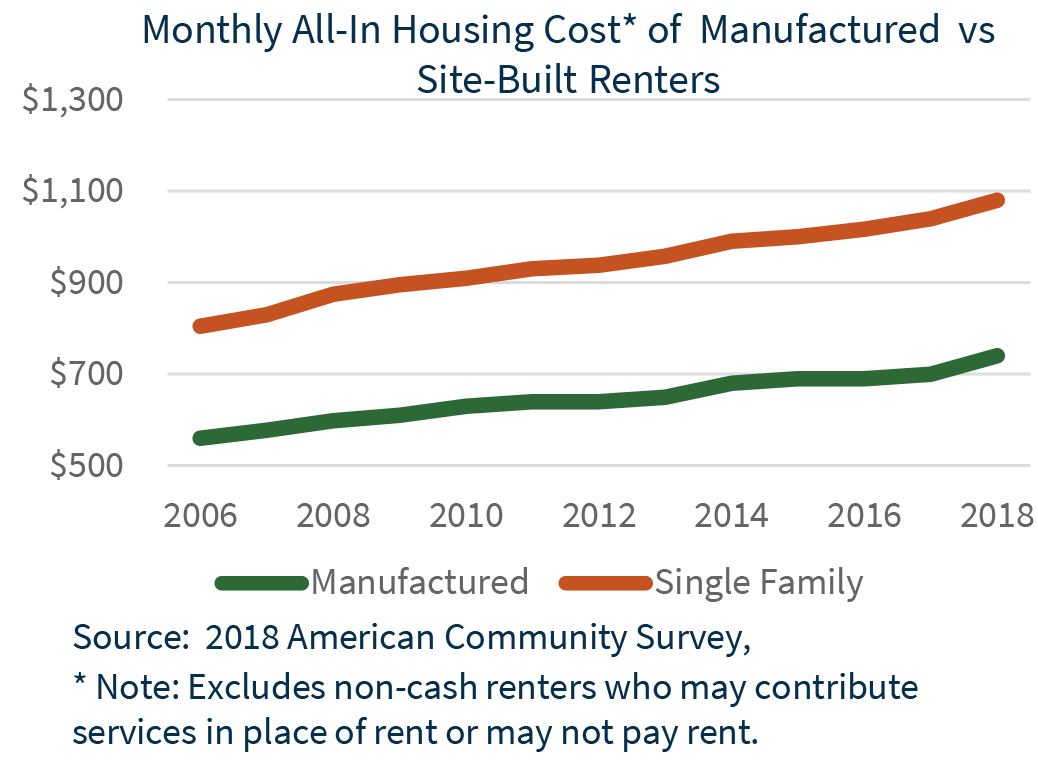

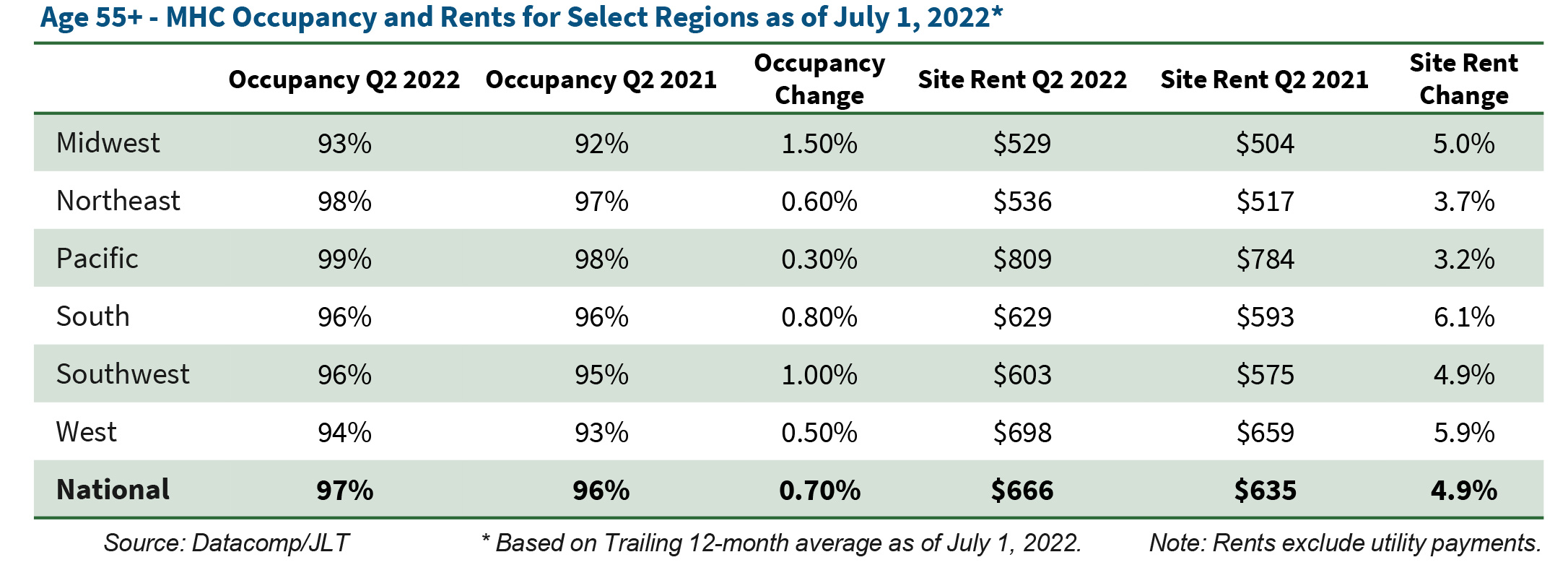

Manufactured Housing And Manufactured Homes Landscape Fannie Mae

Home Financing For Retirees Financing Options For 55 Communities 55places

Americans See The Raging Mania Bad Time To Buy A Home Good Time To Sell A Home Sentiments Spike To Wtf Record Wolf Street

Home Financing For Retirees Financing Options For 55 Communities 55places

Full Article The Low Income Housing Tax Credit Program An Evaluation Of Household Rent Savings

Real Estate Weekly November 18 2022 By Skagit Publishing Issuu

Ask Poli

Ask Poli

Hmr R Services Inc Lake Elsinore Ca

A Slight Increase In The Supply Of New Manufactured Housing Communities Fannie Mae Multifamily